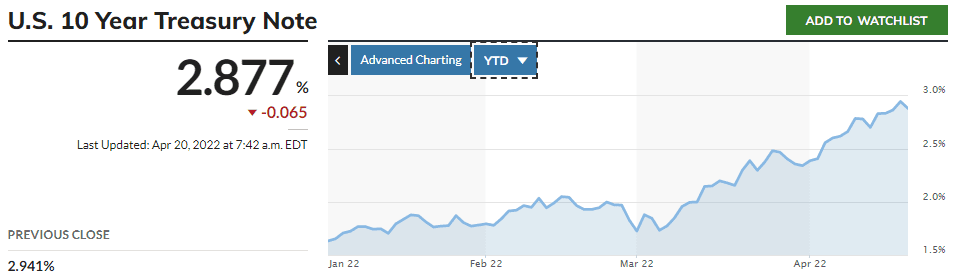

This morning on Vox I read about how our economy’s startup boom is slowing down. This is not a surprising thing to hear as the 10-year treasury note has gone parabolic since the beginning of the year.

The 10-year Treasury yield is a sign of investor sentiment about the economy. While venture investing usually has an 8-10+ year time horizon a rise in rates like this makes investors uncomfortable in their seats.

One thing that will not change is the need for local small businesses that provide the day-to-day services we need. In the venture world, investors love allocating capital into new cutting edge technologies like crypto, web3, proptech (real estate tech startups), and other new apps and services that have a chance of a 1,000x return.

Our Focus

At Grit we are not competing for the overbid slice of the pie when it comes to hot new apps, the next web 3 token, or risky bet that we could make money renting pools.

Our focus is on stable cash-flowing local businesses that are staples to the economy during economic success or downturns.

Most venture investing is inherently risky. Capital allocators make educated bets, and if 9 fail, but 1 is successful, they make asymmetric returns compared to other portfolio models.

We prefer taking a risk-averse approach and seeking to place capital into businesses that cash flow, and improve our local communities.

Leveraging Imprint Digital

We are 9 months deep and 8 team members into scaling our first business, Imprint Digital. This is the backbone of our investment approach.

Our team has over 46 years of experience building brands, creating sales funnels, improving identity, and generating incredible customer experiences across 120+ small to medium size business verticals.

We are leveraging this incredible talent pool and skillset to create outsized investor returns. Our specialized team members know how to accelerate organizational growth.

This laser focus on the growth of Imprint processes and experience is so that we can vertically integrate any SMB acquisition with our business development and marketing team.

Inflation Fears

Inflation puts fear in the heart of some. Inflation also impacts the investor thesis. At Grit we see that inflation is actually in the 15-20% range, this is much higher than what is reported by our nation’s leadership.

Inflation can lead to assets being overbid and bought at a premium. You are even seeing these price bumps in the used car market.

There is fear that new supply may not come, or that capital must be placed or else inflation will eat away savings. Why do we invest in the first place? We want time, or what that money can get us, experiences, improved living, time with family, etc.

When inflation hits hard, we focus on staples of our local economies. Low overhead, and low management cash flowing businesses that do not require the head trauma of managing large teams.

We seek out assets that can be automated with technology.

Why? If we can reduce overhead and improve user experience with technology automation, this reduces the risk of investment. This increases cash flow and internal rate of return (IRR). Ultimately we want the best risk-adjusted return.

Our Focus Q3/Q4 2022

As mentioned our focus is lasered in on making Imprint Digital the best marketing experience for our clients and building out processes and teams so that when we do acquire cash flowing organizations, we can day 1, immediately start improving the customer experience and visibility of the brand.

We will not acquire any businesses that do not cash flow on day 1, or that do not provide equity growth upon acquisition.

Stay tuned for more monthly updates and join our investor list if you would like to get inside information into our future dealflow.